- Joined

- Aug 10, 2013

- Messages

- 20,155

- Reaction score

- 21,475

- Location

- Cambridge, MA

- Gender

- Male

- Political Leaning

- Slightly Liberal

All the links are behind a paywall. I’ve read about this from another source (see below) and it was based on rather old (2013 and before) data and listed two (out of ???) MA plan providers as being ‘major offenders’.

The problem is well-documented and the subject of numerous ongoing legal actions.

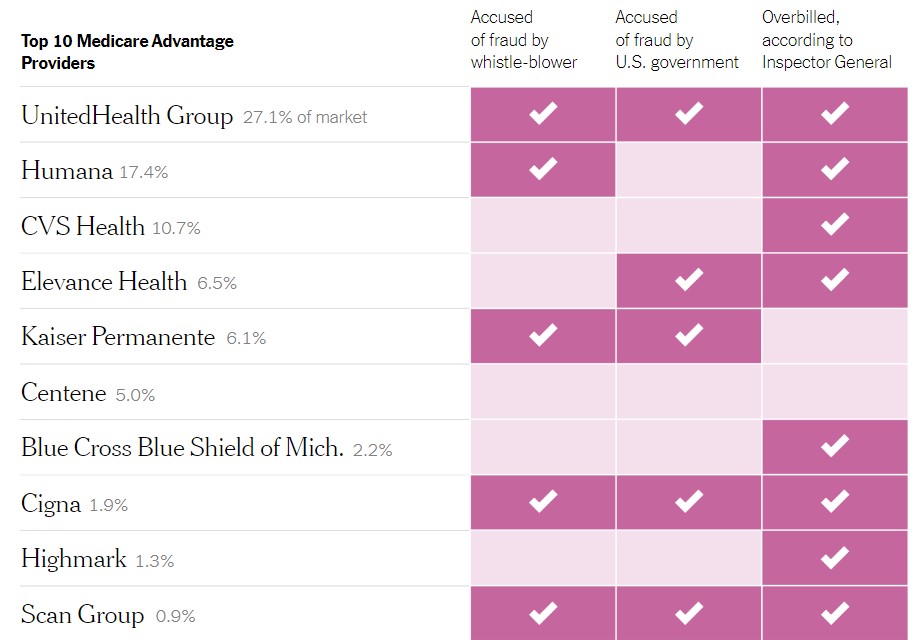

But a New York Times review of dozens of fraud lawsuits, inspector general audits and investigations by watchdogs shows how major health insurers exploited the program to inflate their profits by billions of dollars.

In contrast, regulators overseeing the plans at the Centers for Medicare and Medicaid Services, or C.M.S., have been less aggressive, even as the overpayments have been described in inspector general investigations, academic research, Government Accountability Office studies, MedPAC reports and numerous news articles, over the course of four presidential administrations.

One company, Mobile Medical Examination Services, worked with Anthem and Molina, among others. Its doctors and nurses were pushed to document a range of diagnoses, including some — vertebral fractures, pneumonia and cancer — they lacked the equipment to detect, according to a whistle-blower lawsuit. . . Cigna hired firms to perform similar at-home assessments that generated billions in extra payments, according to a 2017 whistle-blower lawsuit, which was recently joined by the Justice Department. The firms told nurses to document new diagnoses without adjusting medications, treating patients or sending them to a specialist.

The most common allegation against the companies was that they did not correct potentially invalid diagnoses after becoming aware of them. At Anthem, for example, the Justice Department said “thousands” of inaccurate diagnoses were not deleted.

In an October 2021 lawsuit, the Justice Department estimated that Kaiser earned $1 billion between 2009 and 2018 from additional diagnoses, including roughly 100,000 findings of aortic atherosclerosis, or hardening of the arteries. But the plan stopped automatically enrolling those patients in a heart attack prevention program because doctors would be forced to follow up on too many people, the lawsuit said.

A civil trial accusing UnitedHealth of fraudulent overbilling is scheduled for next year. The company’s internal audits found numerous mistakes, according to the lawsuit, which was joined by the Justice Department.