- Joined

- Sep 30, 2019

- Messages

- 28,406

- Reaction score

- 33,219

- Gender

- Male

- Political Leaning

- Liberal

There are two schools of thought amongst analysts trying to predict 2022 markets.

Some analysts are predicting a booming economy as Covid impact diminishes in the spring. At the same time supply chain issues will help to reduce inflation and as a result we'll see a good year overall in the markets.

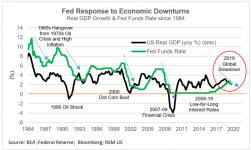

Others are predicting a correction in historical territory. It could be 20% to even 50% and I saw one analyst writing the other day that predicted as much as a 70% drop. The reason for this would be the fact that governments have propped up markets using central bank levers and that party has to come to an end at some point.

What do you think?

Some analysts are predicting a booming economy as Covid impact diminishes in the spring. At the same time supply chain issues will help to reduce inflation and as a result we'll see a good year overall in the markets.

Others are predicting a correction in historical territory. It could be 20% to even 50% and I saw one analyst writing the other day that predicted as much as a 70% drop. The reason for this would be the fact that governments have propped up markets using central bank levers and that party has to come to an end at some point.

What do you think?