Ignored is the fact the top one percent of U.S. households, according to the Federal Reserve,

increased their entire wealth by

about 6 percent in just the 90 days of the final, full Trumpist quarter of a year, during a worldwide pandemic.

Ironically, concentrated wealth oligarchy and the political control it buys is the core crisis, not the debt that is the result of that

control, which feeds on itself and is gathering momentum. The debt is a result of efforts to persuade the vastly superior numbers of

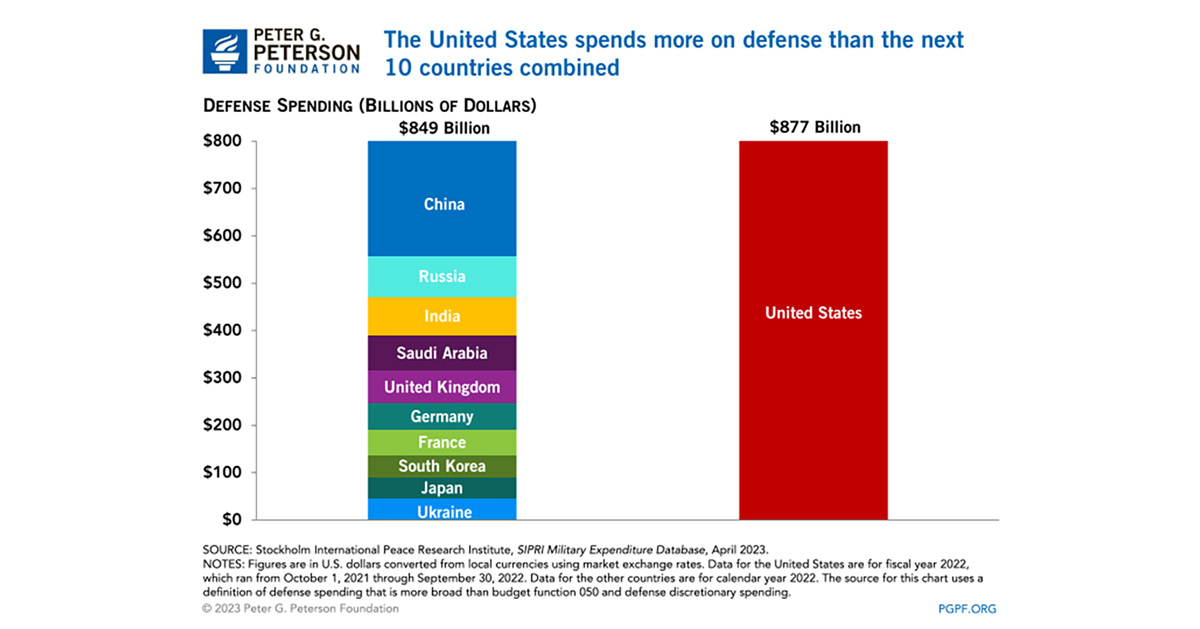

"have nots" to not react similarly to the bolsheviks (1), to the (Tsar-like) control that keeps them from fair compensation for their work and spends and spends on military and military "expeditions" only further enriching the wealthiest. The debt is a combination of a bribe described as social welfare, socializing the losses of the oligarchs to preserve their private profit, and freakishly large military expenditures, example, F-35.

The United States spends more on defense than the next 10 countries combined.

www.pgpf.org

(1).

en.wikipedia.org

"... Putin invited the Romanov imperial family to return to Russia in July 2015. "