teamosil

DP Veteran

- Joined

- Oct 17, 2009

- Messages

- 6,623

- Reaction score

- 2,226

- Location

- San Francisco

- Gender

- Male

- Political Leaning

- Liberal

HOw does capital gains tax rates cost anyone money unless you assume that all wealth belongs to the government.

That's just semantics. I make no assumption about what belongs to who or whatever. I'm a pragmatist. I typically just look at the tangible impacts something has in the world.

It's not about who the wealth belongs to. Everybody has to pay taxes. Why tax people more heavily for working than you tax people for investing? We have created this artificial exemption for investors so they don't have to pay taxes as high as other people do. There isn't a real justification for it. Those are just the people with the most power, so they get what they want.

who is hurt by having lower rates on capital gains.

All of us. Those tax breaks cost us something like a trillion dollars a year to offer. We have to borrow the money to cover that. Whether you see it on your bank statement or not, you had to take out $30,000 in loans during the Bush administration to cover the cost of all those tax breaks. They just hid it from you by doing it as national debt instead of a personal loan, but it's pretty much the same thing in the end.

and there is sound arguments that high capital gains taxes forces capital out of the usa.

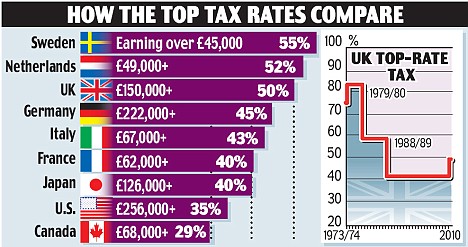

Actually, no, but close. Capital would not be forced out. You are taxed based on where you live, not where your money is invested. So, the same investors would still invest here. However, you could argue that the investors would move away. I guess that is probably sort of true to an extent, but most countries already charge higher capital gains taxes than we do and nothing like a mass exodus happened in those countries.

And, really, it wouldn't make such a big impact on the people who make their income by investing really. Not enough that somebody would want to move. The difference between $10 million and $8 million isn't really something that would effect your quality of life, so I doubt people would move just over that.