A helping hand. Unlike Madison.

Some call it charity, others call it "

social democracy". In either case, it is the political will to assure that all a nation's citizens have an equal footing with which to embark upon life and pursue it without fear.

Like free postsecondary schooling to have the skills/competencies necessary to find good jobs nowadays. And a helping-hand along the way when sickness or misfortune befalls them. Like a universal National Health System that cares for their sickness if unemployed free, gratis and for-nothing. (And does not prevent them seeking assistance when they need it most because of indecently high costs. Before ObamaCare, 16% of the American population had

No Medical Insurance whatsoever and many died as a result because "ER" is not enough when the damage has been done!)

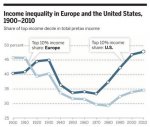

Notions of a helping-hand when needed are predominant in most developed countries today. It's only the US that has become "carried-away" (and I am being polite) by the Money-Money-Money Madness. It's a wicked infection, and if our founding-fathers were to see how it has captivated Americans they'd turn sick.

The same venality of 18th century European monarchic rule now afflicts the United States, despite the fact that we fought a revolution to free ourselves as a nation. And here we have it again - that same

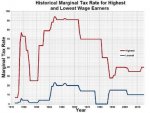

hegemony has snuck in the back door during Reckless Ronnie's Rule.

We have created our own "royalty" and their new megabuck-Prince is The Donald - like him or not.

He's one of

yours, not one of mine ...

____________________________________