- Joined

- Aug 10, 2013

- Messages

- 20,183

- Reaction score

- 21,526

- Location

- Cambridge, MA

- Gender

- Male

- Political Leaning

- Slightly Liberal

Lots of stuff in the $1.9 trillion package the House Ways and Means Committee released today (to be marked up starting Wednesday):

waysandmeans.house.gov

waysandmeans.house.gov

One notable item:

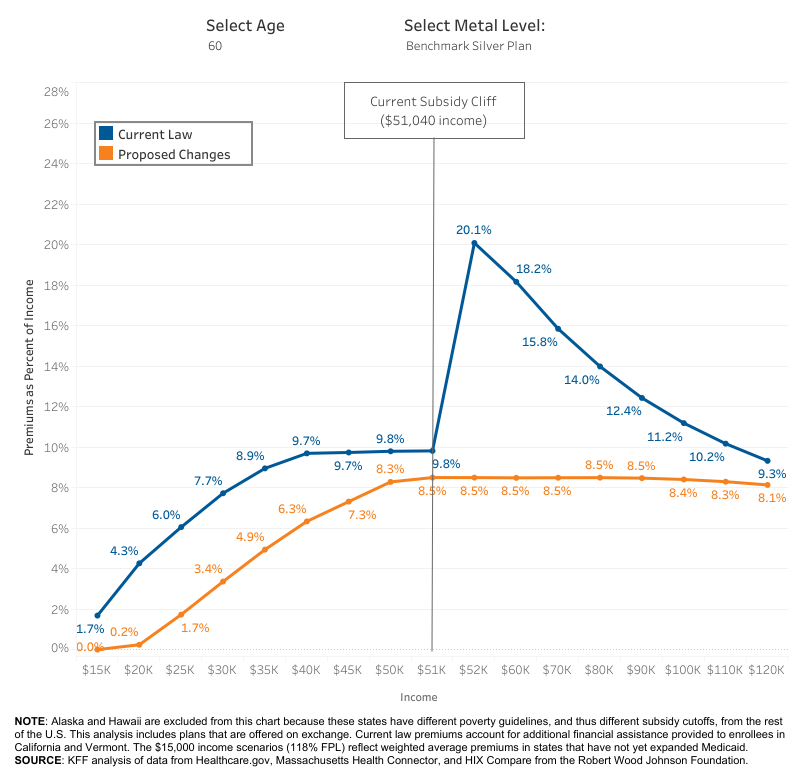

How does it do that? It changes the way premium tax credits are calculated under the ACA to make them both more generous and more widely available (i.e., to people with incomes above 400% of the federal poverty line). Making premiums more affordable this way has been a key Dem goal for years and now is as good a time as any to provide relief to people.

Here's the difference in how much people have to contribute to a marketplace plan:

Current law

COVID relief package:

You can play around with the poverty thresholds to figure out the implications for any given family but as some examples:

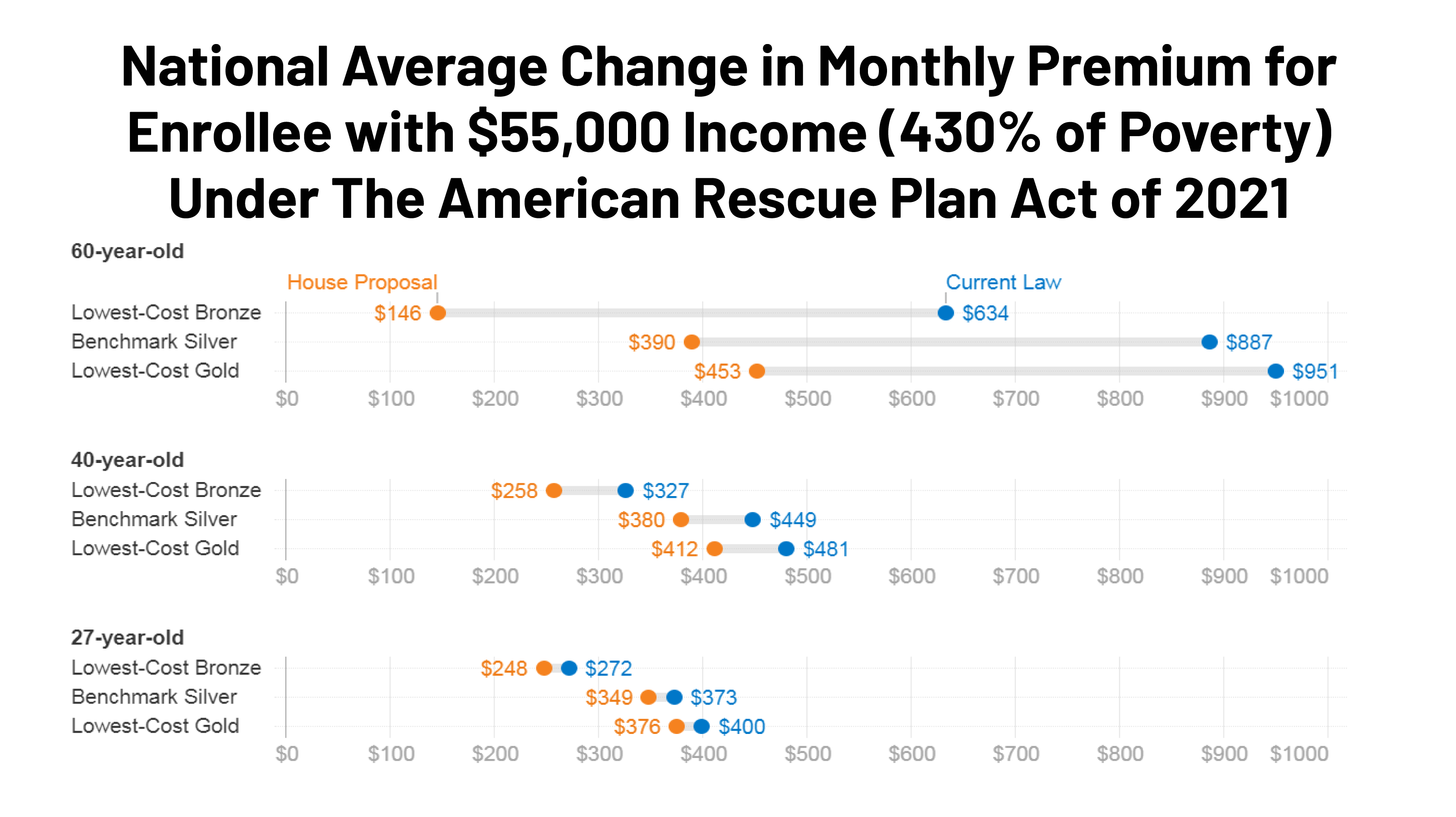

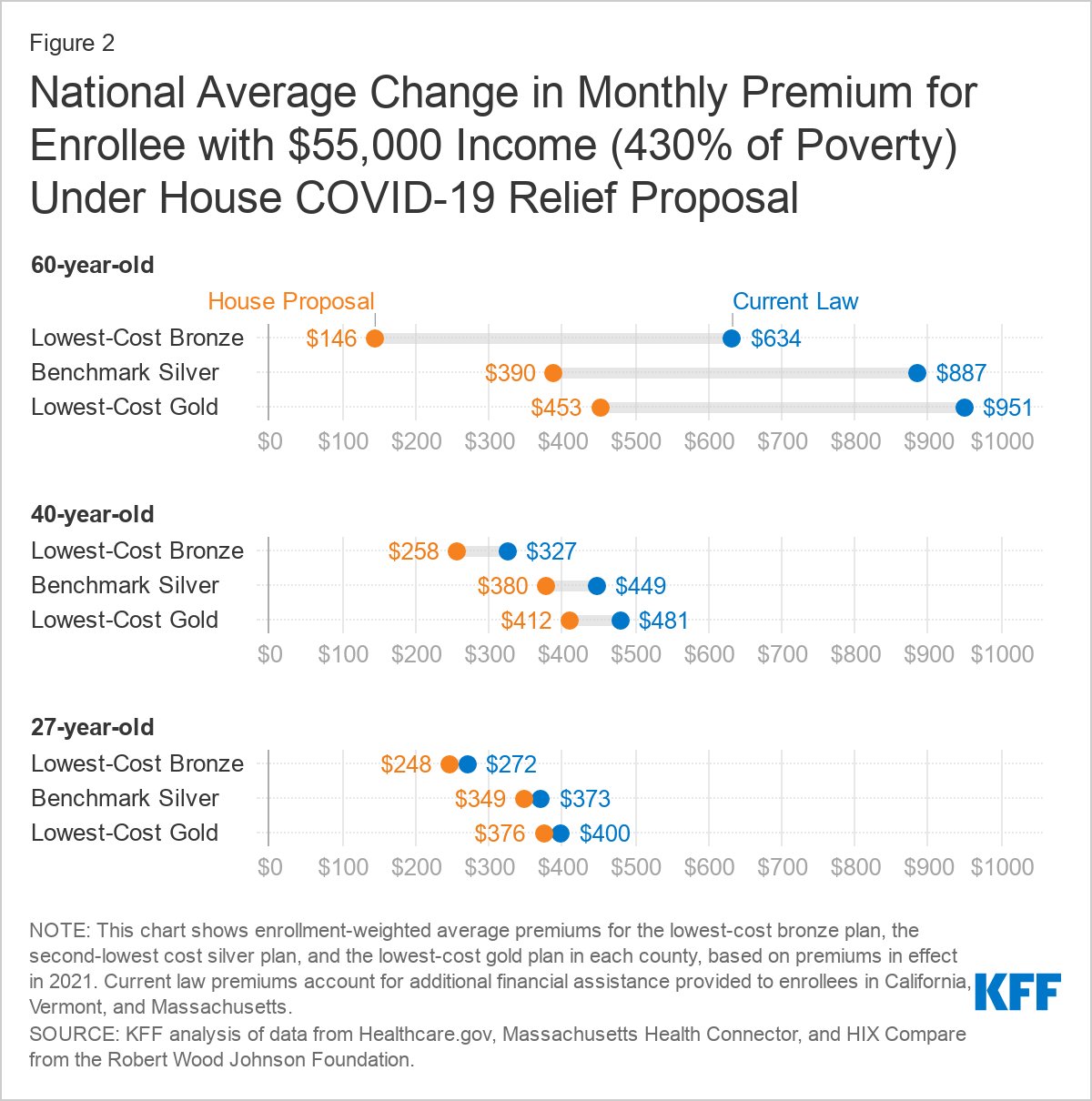

The long and short here being that a lot of people would see a lot of premium relief, particularly those at the bottom of the income ladder and those middle class folks who make too much to qualify for premium tax credits.

Chairman Neal Announces Markup of COVID-19 Relief Measures

SPRINGFIELD, MA – Today, House Ways and Means Committee Chairman Richard E. Neal (D-MA) announced the Committee will consider nine legislative proposals under the budget reconciliation instructions this week as the next step in delivering COVID-19 relief to the American people. Beginning on...

One notable item:

Reduces health care premiums for low- and middle-income families by increasing the Affordable Care Act’s (ACA) premium tax credits for 2021 and 2022.

How does it do that? It changes the way premium tax credits are calculated under the ACA to make them both more generous and more widely available (i.e., to people with incomes above 400% of the federal poverty line). Making premiums more affordable this way has been a key Dem goal for years and now is as good a time as any to provide relief to people.

Here's the difference in how much people have to contribute to a marketplace plan:

Current law

| Income | Contribution toward a benchmark premium (Percent of income) |

| Less than 133% FPL | 2.07% |

| 133% FPL | 3.10% |

| 150% FPL | 4.14% |

| 200% FPL | 6.52% |

| 250% FPL | 8.33% |

| 300% FPL | 9.83% |

| Above 400% FPL | Full premium (no subsidy) |

COVID relief package:

| Income | Contribution toward a benchmark premium (Percent of income) |

| Less than 150% FPL | 0.0% |

| 150% FPL | 0.0% |

| 200% FPL | 2.0% |

| 250% FPL | 4.0% |

| 300% FPL | 6.0% |

| 400% FPL and above | 8.5% |

You can play around with the poverty thresholds to figure out the implications for any given family but as some examples:

- A single person making $32,200 (250% FPL) would see their premium contribution for a benchmark plan fall from $224/month to $107/month

- A couple making $26,500 (150% FPL) would see their premium contribution fall from $90/month to zero.

- A family of 4 making $106,300 (just over 400% FPL) would go from paying $1,484/month* to $751/month

The long and short here being that a lot of people would see a lot of premium relief, particularly those at the bottom of the income ladder and those middle class folks who make too much to qualify for premium tax credits.