csbrown28

DP Veteran

- Joined

- May 6, 2013

- Messages

- 3,102

- Reaction score

- 1,604

- Location

- NW Virginia

- Gender

- Male

- Political Leaning

- Undisclosed

I it possible to to shrink the debt and grow the economy?

If so, how?

If so, how?

I it possible to to shrink the debt and grow the economy?

If so, how?

I it possible to to shrink the debt and grow the economy?

If so, how?

I it possible to to shrink the debt and grow the economy?

If so, how?

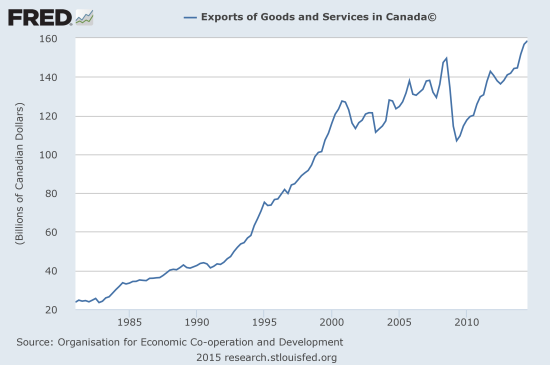

Canada slashed their huge deficit in the 90's and ran 13 years of surpluses...and their economy did generally great during that time.

Clinton balanced the budget and the economy did well.

Whereas Japan has run one massive deficit after another for decades and what has it got them? The famous 'lost decade' which is becoming 'the lost generation', a stock market not even half of what it was in 1990, at least four times as many negative GDP quarters as America has had since the early 90's AND roughly 45% of their federal taxes goes just towards debt servicing. They are so desperate that they have their Central bank actually buying huge amounts of stocks directly (through ETF's) to try and pump up the markets.

I will not debate these facts as it is clear that many/most people that love deficits have INCREDIBLY closed minds on the subject...the effort would be wasted.

But this idea that some/many people have that you have to run deficits to grow an economy is absolute nonsense and proven wrong by history time and time and time again.

I it possible to to shrink the debt and grow the economy?

If so, how?

Sure, eliminating waste while not slashing even a penny of anything that goes into investing for the future (education, infrastructure, etc.).

I would argue that if we were running deficits because we invest A LOT in to our future, then deficits would be great for the economy, as opposed to being austere and having surpluses but not investing in the future.

A lot of it comes down to waste vs invest

Deficits aren't bad by virtue of being deficits, nor are surpluses good by virtue of being surpluses.

I it possible to to shrink the debt and grow the economy?

If so, how?

How? It may not be popular or the way to go but you did not add any stipulations.

Cap income to 2 million a year, everything above that is taxed 100%

This would achieve two things, It would raise tax revenues by a large margin but for those not wanting to send their money into the IRS they could take the other option and that is to spread (pay) that money out among others that make less than 2M, people who are much more likely to spend a great deal of that money, thus boosting the economy and lowering out deficit.

How? It may not be popular or the way to go but you did not add any stipulations.

Cap income to 2 million a year, everything above that is taxed 100%

This would achieve two things, It would raise tax revenues by a large margin but for those not wanting to send their money into the IRS they could take the other option and that is to spread (pay) that money out among others that make less than 2M, people who are much more likely to spend a great deal of that money, thus boosting the economy and lowering out deficit.

Of course it is possible. It just becomes more of a challenge when you run an economic model dependent upon government spending, which tends to push that spending to the point of adding new debt no matter what the condition of the economy (or, where we are in the economic cycle.) The question then becomes what is the design of the economic policy that tends to ensure continued debt in economic models dependent on the government.

Are we talking about economic policy that is designed to prop-up and/or boost short-term demand with stimulus spending? The general idea being that GDP can be accounted for by increasing government spending (G) as an effort to boost aggregate demand, eventually the economic model improves suggesting short term additions to debt. Or, so the theory goes.

Alternatively, are we talking about some derivative of supply side economics where if wealth is boosted and/or encouraged to invest then everyone else does well (the so called "trickle down theory" sometimes in concert with austerity measures?) The general idea being that if wealth is confident in the economic model, investment will lead to boosted GDP via private investment (I.) Again, or so the theory goes.

Our inherent problem is government economic policy tends to be more about political benefit than economic theory, so handling aggregate demand concerns becomes secondary at best. That is another way of saying that today's Democrats are no more about Keynesian Economics than Republicans are about alternative economics. It is all a game of pandering to political support and ultimately votes, and that gets in the way of sound economic policy.

That basic fact explains why we tend to add to Total Debt (usually Debt held by the Public) no matter who controls the White House, who controls Congress, what the Fed is doing, and wherever we are in the economic cycle. We add to debt during contraction, recession, at the point of Trough, during the recovery, well into expansion, and of course right up to the point of the next economic peak. Debt, debt, and more debt just for good measure. Complements of a Fiat Money System, that inherently allows for monetary value degrade to handle persistent debt spending demands. The average growth trend line of our economic model then is mostly irrelevant, and has in itself been dependent upon government spending going back decades now. Again, no matter if times are good or not so good. There is always a political reason to go into more debt without it really being sound economically (or fiscally.)

Our real challenge then is getting to a point where GDP growth is not entirely dependent upon government spending every single year to handle our bubble and pop economic model. That is a real challenge and presents a real departure from whatever ole (D) and (R) tells you is sound economic policy.

I would argue that our real economic growth is how well we set conditions for entrepreneurship and employee hiring, and it means considering what Keynes was saying (as in what he was really saying... not what today's Democrats and Liberals try to tell you about deficit spending all the time, debt does no matter, micro-manage the economy, and all the other nonsense that Keynes never actually said.)

The question wasn't meant to be that complicated, though I appreciate your in-depth response.

If the government is reducing its spending and the private sector wishes to continue growth, then it must borrow or give up services.

States would also be impacted as a reduction in spending by the government would lead to need for high taxes to maintain services or eliminate services. Lastly a state could increase state-to-state exports. This of course might help resource rich (natural and intellectual) states like CA and TX, but in the aggregate would be a net negative across the economy.

If spending is someone else's income, than it stands to reason that the last place left for "growth" is private sector spending fueled by borrowing (a larger portion of which will go to taxes, if the state is to maintain its spending on services), or exports.

It seems that growth without government deficit spending is as unsustainable of not more so since the states have no power of the creation of the currency. The desire for services won't decline, but the availability will with the only answer being private sector borrowing, which come at much higher cost than government debt and can only be financed by future productivity. When deleveraging happens at the private level, productivity will sink and the deflationary spiral would begin.

Your concerns, it seems to me, seem to be on how to manage the risk that comes with a booming economy.

Look at it this way. If spending were less than tax revenues, then the only borrowing going on would be what government ran trust funds have to engage in as a matter of law. Meaning government could still spend and impact GDP (the G part of the GDP equation) when there is aggregate demand fault.

Your inherent problem is the assumption that all current spending is for "services" that we cannot live without and/or the economy would somehow suffer without.

But our economic model has become accustom to expected growth all the time. It is the reason that 2% growth does not feel like growth at all, 4% seems amazing, and flat growth feels like economic collapse. Dependency on government spending irregardless of the status of the economy suggests better policy is to break that dependence and thus giving us a better chance to decide when running deficits is acceptable and when it is not, and when adding debt is acceptable and when we should avoid doing so.

All income falls under the FIT including capital gains and dividends.

FIT rates lowered. Tax deductions removed. Tax code simplified. Overall revenue still increases to just exceed current spending.

Welfare reform- need to stop drawing these lines where benefits get cut off. Government forces companies to demonstrate profit margins. In some industries with large profit margins (like Comcast), set up the government to compete with companies like Comcast by employing welfare recipients. Employ the unemployed to put these businesses in check. Temporary expenditure to set up, should pay for itself pending tactful deployment in profitable sectors.

Suffering? I would simply say that there would be business that wanted to get don't that would be constrained from doing so due to a lack of fiscal resources. The difference between the two would be forever lost productivity. That would only matter if there were people who wanted to work but could not due to a lack of employment.

Well it would seem that an increase of 105,000 net people entering the workforce per month (2012 stat), growth is necessary. Add to that productivity gains, that is, doing the same amount of work with fewer people, would also increase the need for growth simply to maintain the standard of living.

I it possible to to shrink the debt and grow the economy?

If so, how?

Your issue with the argument is the difference between increases in spending as a means to ensure constant spending per capita vs. simply more spending per capita. The former suggests what you are talking about with any population growth, as that occurs then raw spending goes up to keep spending per capita roughly the same. The latter is what really happens, increases in government size and scope where spending per capita goes up, meaning economic system dependency on debt based government spending goes up.

And speaking of maintaining a standard of living, there is no government social safety net to handle some economic fault that keeps up with this concept. Not a single one. They may try and make plenty of adjustments over the year, but none have kept up with CPI or PCE based inflation math.

The basic problem is still the same. To grow the economy means to encourage its activity thus speak to business activity and entrepreneurship, to encourage dependence on government does the exact opposite causing more economic lag than benefit.

I think my tax plan below would bring in very high economic growth and high government revenues.

No deductions, no joint filing, no payroll taxes.

$0-$12,000----0%

any additional net income between $12,000-$40,000----10%

any additional net income between $40,000-$100,000----20%

any additional netincome between $100,000-$250,000----28%

any additional net income above $250,000----38%

0% inheritance tax

0% corporate tax

eliminate any taxes companies pay on SSI, Medicaid, unemployment insurance

eliminate the need for companies to provide employee health insurance by each state going to a single payer catastrophic/cash and charity for minor stuff

tax capital gains like regular income at the 10/20/28/38% rates except when companies offer stock to raise money and then have a 15% rate

States:

0% income tax

0% corporate rate

tax carbon at real costs

tax unhealthy stuff at real cost such as non whole foods and beverages, cigarettes, alcohol, etc

raise other revenue through sales tax(no value added taxes) and property tax

By bringing manufacturing and jobs back home. Incentives and import duties can help in the effort. The problem with our economy started 30 years ago when we started sending our jobs and money to other countries. There won't be any meaningful economic growth until that trend is reversed.