I question whether it really is using up resources that would otherwise be used.

Your questioning is arbitrary.

Crowding out private investment isn't a matter of competition for resources. Again, i'm describing crowding out of private investment when the economy is growing.

It's bird in the hand; at least with pork, something gets built for sure, and people get paid. I agree that pulling workers away from real projects isn't good, but I just don't think that's happening. Not since WWII, really.

When the economy is growing at it's potential, deficits necessarily raise real interest rates. It is rare in our current environment given the relationship between tax revenue and economic growth, such that during extended growth periods, deficits decline. However, there have been instances where the economy has been operating at it's potential and deficits have risen, thereby crowding out the private sector. This does happen whether you can see it or not... investments that would have been made are moth-balled and the long term trajectory of the economy is undercut.

Chinese investment in companies, sure - but isn't that accounted for already, in the current account?

The current account includes public and private investment of foreign funds. I don't understand why you would say

it's already accounted for. Foreign investment is a component of investment in the NIPA identity.

But "investment" in treasuries doesn't fund government spending.

Of course it does. While there are no broker dealers that take orders from Beijing, Chinese funds used to purchase treasury securities do flow into the overall economy.

And that's the "savings" I''m referring to (and the surplus that sectoral balances refers to). Treasuries are just dollars at rest, usually forever. With or without the Chinese (or anybody else) buying treasuries, the deficit would remain the same.

Sectoral balances tell us nothing about the economy that is not already known.

That, I blame on bad policy. Savings have always accumulated with the rich, there is no way around that, but the more that labor can demand, the less we need deficit spending.

Deficit spending is needed when the economy is operating below it's productive potential. When the economy is operating at it's potential, as already stated, deficit spending is a headwind to long term economic growth. In other words, future consumption, investment, government spending, imports, and exports will likely be lower than they would have been otherwise, without a net benefit to the short run.

None, of course. But that doesn't mean a large chunk of our labor force has to remain idle, either.

Frictional and structural unemployment are a reality that simply can't be waved away with deficits.

I'm not looking to compete with the Chinese in low-end manufacturing.

Do you believe imports are a negative for economic growth, all else equal?

Income is what buys the vast majority of stuff, and when income is lost to savings, that's a real loss that needs to be made up for. Demand leakages are very real, and they are not just an MMT idea.

We've already agreed that investment is derived from savings. Do we also agree that investment is a determinant to long term economic growth?

I just don't see that happening in reality. Too much unemployment and underemployment to believe that labor is one of those resources. And what else are we running short of, to the point where prices are rising because of too much demand? I just don't see government spending overlapping with private sector investment.

This point is entirely arbitrary.

But the government is borrowing at crazy low rates, rates that they set. They aren't competing with businesses. People buy treasuries for safety, for pension funds, etc. Further, when you consider that every dollar used to buy treasuries goes right back into the private sector, where is the dollar shortage?

They don't crowd out private investment when the economy is operating below it's potential, for the same reason that downturns occur... firms are not willing to invest at previous levels. Had firms felt confident enough to earn higher rates of return from the private sector, investment would grow.

Well, I agree with this, as I said earlier. But I'd rather have politicians making their decisions based on better assumptions than to have them hold back needed spending because they are afraid of the national debt.

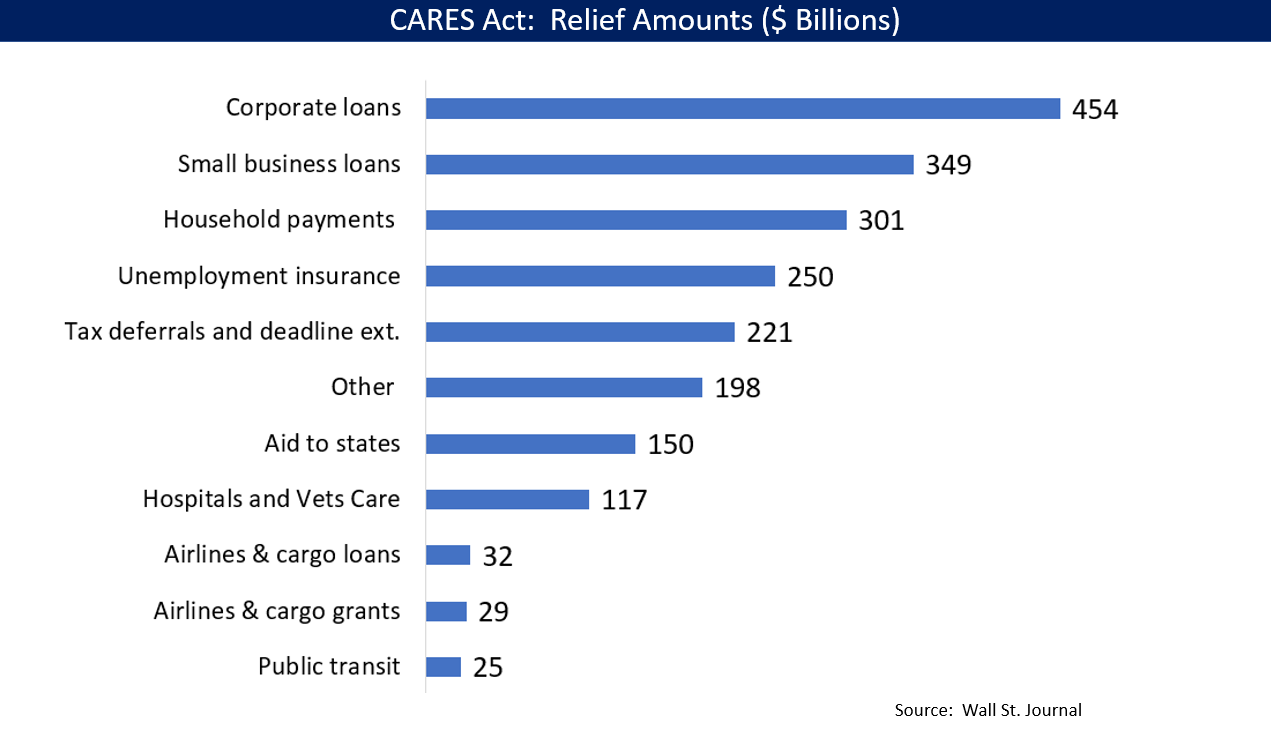

Look at the recent stimulus. They really didn't hold anything back this time, other than choose to bail out businesses at a rate of 2:1.