- Joined

- Sep 16, 2007

- Messages

- 9,796

- Reaction score

- 2,590

- Location

- out yonder

- Gender

- Male

- Political Leaning

- Slightly Liberal

Lets here if for the (though belated) fiscal responsible Republican Party.:roll:

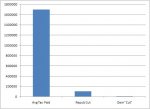

<A Republican plan to extend tax cuts for the rich would add more than $36 billion to the federal deficit next year -- and transfer the bulk of that cash into the pockets of the nation's millionaires, according to a congressional analysis released Wednesday. >

washingtonpost.com

http://www.washingtonpost.com/wp-dy...8/11/GR2010081106717.html?sid=ST2010081200375

<A Republican plan to extend tax cuts for the rich would add more than $36 billion to the federal deficit next year -- and transfer the bulk of that cash into the pockets of the nation's millionaires, according to a congressional analysis released Wednesday. >

washingtonpost.com

http://www.washingtonpost.com/wp-dy...8/11/GR2010081106717.html?sid=ST2010081200375

Last edited: