- Joined

- Dec 13, 2015

- Messages

- 9,594

- Reaction score

- 2,072

- Location

- France

- Gender

- Male

- Political Leaning

- Centrist

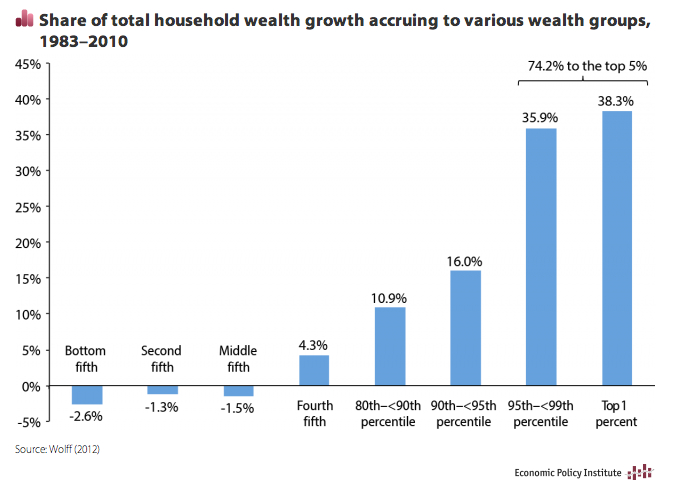

Improving the whole economy would mean improving the lives of the people they hate

Perversion in the governance of a nation is nothing new.

All it takes is an ignorant portion of the population to want, at all costs, dominate the electoral system. Then say, "No! No! No!" to any and all laws or measures that are meant to maintain fairness and impartiality that might threaten their tax-advantages assuring them massive Income and, thus, Wealth ...

The existence of the lowest-classes are to furnish cheap labor that produces goods/services for the economy; which itself then provides the profits that, in turn, becomes their Income. And after minimal flat-tax payments then gushes up into first Wealth and then Net Worth.

And all is well with the world. Their tiny, selfish and inhuman world ...

________________________