You did not post a link because very likely you are aware of the reputation of the WSJ editorial board,

Revenue is surging, exceeding what CBO and critics predicted.

www.wsj.com

Corporate Tax Reform Worked

Revenue is surging, exceeding what CBO and critics predicted.

April 19, 2022

This was published one month before the era of pandemic driven, government stimulus and Federal Reserve "accommodation on steroids,"

Link to cached page of this article,

https://www.forbes.com/sites/christianweller/2020/01/29/trumps-wasteful-tax-cuts-lead-to-continued-trillion-dollar-deficits-in-expanding-economy/?sh=5846fa8e66c4

Trump’s Wasteful Tax Cuts Lead To Continued Trillion Dollar Deficits In Expanding Economy

Christian Weller Senior Contributor

Jan 29, 2020,

"...This is the opposite of tax cuts paying for themselves.

CBO released its regular update to the economic and budget outlook on January 28. The

new estimates show a deficit of $1 trillion for 2020. This is the equivalent of 4.6% of gross domestic product. The federal budget deficit will grow to 5.4% of GDP by 2030, according to GDP.

This is a much worse outlook for the current deficit than CBO showed just before Congress passed the Trump tax cuts. In June 2017, CBO anticipated a deficit of 3.6% of GDP for 2020. The current deficit is thus 27.8% greater than CBO projected before the tax cuts. .. difference in the current projected deficit and the prior projection equals

$221 billion for 2020. This is a substantial gap that follows in large part from the tax cuts,..."

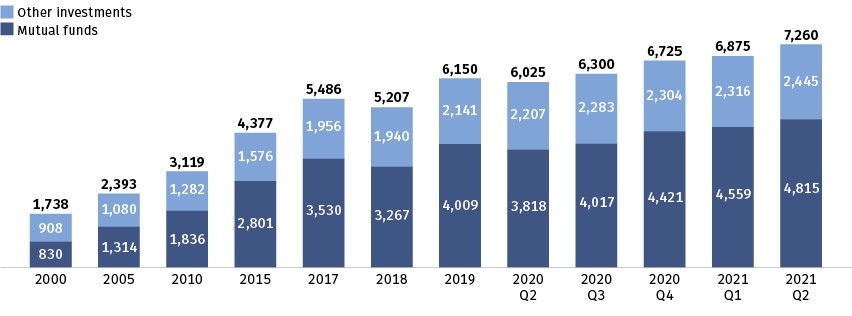

The only figures I agree with the Tax Foundation on are the corporate tax receipts of fiscal year ending Sept. 30, 2021,

and I documented why they were dramatically higher,

Covid-19 federal borrowing of $5 trillion in that one fiscal year and Federal Reserve "accommodation". I also supported the contention that the 2017 Trump-McConnell tax cuts failed to deliver as promised in 2018-19 (see below).

en.wikipedia.org

Reception

"In a column for

The New York Times blog

The Upshot, Josh Barro, a former Tax Foundation employee, criticized the group's approach to scoring the Rubio-Lee tax plan as producing "implausibly rosy results." ...

In opinion editorials for the

New York Times, economist

Paul Krugman has characterized the Tax Foundation as "not a reliable source" while criticizing a report by the Tax Foundation comparing corporate tax rates in the U.S. to those in other countries. Krugman has also accused the Tax Foundation of "deliberate fraud" in connection with a report it issued concerning the

American Jobs Act. The Tax Foundation has published various responses to Krugman's criticisms."

https://www.unionleader.com › opinion › our-choice-is-jo...

Oct 25, 2020 — "...Since Trump took over, the national debt has exploded by more than 7 TRILLION dollars. While the last several trillion was in response to the COVID-19 economic crisis,

at least the first three trillion was on the books well before the pandemic, while Trump was presiding over “...the best economy we’ve ever had in the history of our country.”

(Trump’s words.)

The layman

would expect that the best economy in history would be a time to get the fiscal house in order, pay down debt and prepare for a rainy day (or perhaps a worldwide pandemic). .."

:max_bytes(150000):strip_icc()/GettyImages-1162928066-aefd2efafc0a4cfa85d11c5bf032b17b.jpg)