- Joined

- Dec 13, 2015

- Messages

- 9,594

- Reaction score

- 2,072

- Location

- France

- Gender

- Male

- Political Leaning

- Centrist

COULD NOT CARE LESS

Your cost-benefit is a spurious alternative notion when the Employment-to-population ratio is down to 58.5% and the nation's unemployment rate is at 10%. The worst post-war economic situations in which the US ever found itself.

Who, pray tell, needs cost-benefit when there is no cost? The Fed prints money, and the government spends it. Lo and behold, people get back to work, earn incomes and spend it! (Wow! Miraculous!) The resulting increase in tax-revenues pay for the stimulus and reduces the debt - unless a succeeding PotUS continues to not balance-the-budget.

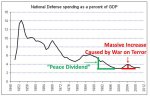

A VIVID INFO-GRAPHIC

If the US has an historically high Debt, why not seek the answer to "Why?" by looking at the extravagant cost of the Gulf War? Nobody ever think of that. Or, how about looking at the origins of a runaway national debt in this infographic here:

Who was PotUS when the debt started climbing drastically in 1980s and why did it do so? (Because Reckless Ronnie diminished drastically upper-income taxation!) What happened to the debt during the Clinton years of 1993/2001? (The debt was reduced.) What happened to the debt during the Dubya Iraqi War-years up to 2008? (The debt skyrocketed once again.)

And so who are, in fact, the real debt-culprits?

MY POINT?

You are insinuating that in such a dire situation, a "cost-benefit analysis" is required - as if there were some accounting alternative that was better. (Quantitative Easing proved there was none.)

The stimulus-spending solution has worked many a time throughout history in recessions, all around the world; and as recently in the US in 2009/10 when the solution stopped (slam dunk!) the Unemployment rate from skyrocketing beyond 10%.

And conservatives in America remain desperate for an excuse as to why Stimulus-Spending is not necessary. Face it, they've got an innate problem with BigGovernment and no substantiation for their dislike worth mentioning.

They are knee-jerking at the altar of "do nothing" because "doing something" would entail increasing Income Taxation at the Upper-Income levels where they are presently flat-taxed at a measly 30%.

We are already in the Best of All Possible Worlds? Wakey, wakey! In fact, 50 million Americans are incarcerated below the Poverty Threshold.

And the Replicants could not care less ... !

Ah ha! Finally something we can agree about! Will wonders never cease ...

______________________________

So long as Keynesians do not include a cost/benefit analysis of what the government crowds out when it gets the money to spend, they will continue to only be scoring one side of the ledger.

Your cost-benefit is a spurious alternative notion when the Employment-to-population ratio is down to 58.5% and the nation's unemployment rate is at 10%. The worst post-war economic situations in which the US ever found itself.

Who, pray tell, needs cost-benefit when there is no cost? The Fed prints money, and the government spends it. Lo and behold, people get back to work, earn incomes and spend it! (Wow! Miraculous!) The resulting increase in tax-revenues pay for the stimulus and reduces the debt - unless a succeeding PotUS continues to not balance-the-budget.

A VIVID INFO-GRAPHIC

If the US has an historically high Debt, why not seek the answer to "Why?" by looking at the extravagant cost of the Gulf War? Nobody ever think of that. Or, how about looking at the origins of a runaway national debt in this infographic here:

Who was PotUS when the debt started climbing drastically in 1980s and why did it do so? (Because Reckless Ronnie diminished drastically upper-income taxation!) What happened to the debt during the Clinton years of 1993/2001? (The debt was reduced.) What happened to the debt during the Dubya Iraqi War-years up to 2008? (The debt skyrocketed once again.)

And so who are, in fact, the real debt-culprits?

MY POINT?

You are insinuating that in such a dire situation, a "cost-benefit analysis" is required - as if there were some accounting alternative that was better. (Quantitative Easing proved there was none.)

The stimulus-spending solution has worked many a time throughout history in recessions, all around the world; and as recently in the US in 2009/10 when the solution stopped (slam dunk!) the Unemployment rate from skyrocketing beyond 10%.

And conservatives in America remain desperate for an excuse as to why Stimulus-Spending is not necessary. Face it, they've got an innate problem with BigGovernment and no substantiation for their dislike worth mentioning.

They are knee-jerking at the altar of "do nothing" because "doing something" would entail increasing Income Taxation at the Upper-Income levels where they are presently flat-taxed at a measly 30%.

We are already in the Best of All Possible Worlds? Wakey, wakey! In fact, 50 million Americans are incarcerated below the Poverty Threshold.

And the Replicants could not care less ... !

Both men are/were pretty thin skinned, but Trump is in no way an intellectual match for Hamilton, who is commonly underrated as merely a particularly prickly Federalist.

Ah ha! Finally something we can agree about! Will wonders never cease ...

______________________________