“In 2013, economists Alan Blinder and Mark Watson — no wild-eyed liberals, they —

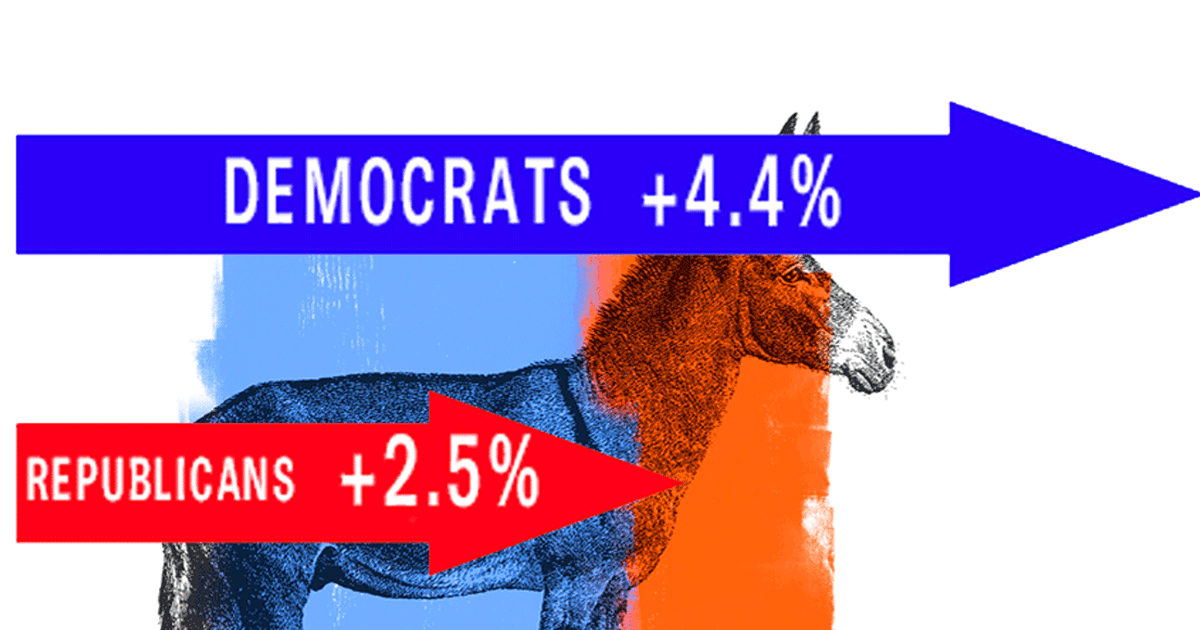

asked a very important question: Why has the U.S. economy consistently performed better under Democratic than Republican presidents, “almost regardless of how one measures performance”?

Start with their “performed better” assertion: it’s uncontestable. While you can easily cherry-pick brief periods and economic measures that show superior economic performance under Republicans, over any lengthy comparison period (say, 25 years or more), by pretty much any economic measure, Democrats have outperformed Republicans for a century. Even Tyler Cowen, director of the Koch-brothers-funded libertarian/conservative Mercatus Center,

stipulates to that fact without demur....

The difference is big. At those rates, over thirty years your $50,000 income compounds up to $105,000 under Republicans, $182,000 under Democrats — 73% higher. (And this is all before considering distribution — whether the growing prosperity is widely enjoyed, or narrowly concentrated.)

Hundreds of similar pictures are easily assembled — different time periods, different measures, aggregate and per-capita, inflation-adjusted or not — all telling the same general story. No amount of hand-waving, smoke-blowing, and definition-quibbling will alter that reality. (If you feel you must try to debunk Blinder, Watson, and Cowen: be aware that you almost certainly don’t have an original argument. Read the paper, and follow the footnotes. You’ll also find more.”

Wisdom of the Crowds. Preventing Government Capture. Labor Market Flexibility. Freedom to Innovate. Profitable Investments in Long-Term Growth. Power to the Producers. Fiscal Prudence. Labor and Trade Efficiencies.

evonomics.com