Well, no, not really. Mostly shows more of GDP remains with those that generated it. The actual numbers I posted tell the story.

Posts from 2018 about presidential administrations and the federal deficit have resurfaced on Facebook recently. We rate them missing context.

www.usatoday.com

The baseline for President Bill Clinton, who entered the White House in 1993.

By the time he exited, there was a

$128.2 billion surplus.

That was the starting point for President George W. Bush, who took over the White House in 2001.

By the time he left in 2009, there was a

$1.41 trillion deficit.

That was the baseline for President Barack Obama, who entered the White House in 2009.

By the time he exited in 2017, there was a

$665.4 billion deficit

— about half of what it was when he entered.

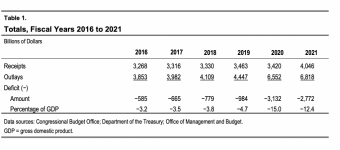

That was the starting point for President Donald Trump, who came to the White House in 2017.

By the time Trump leaves in 2021, there will be a

$966 billion deficit,

according to estimates from the Office of Management and Budget.

According to those figures,

it's true that just Clinton and Obama

— the only Democrats besides Carter in the last 50 years

— left the Oval Office in a year with a lower deficit than the year when they arrived.

Some other presidents lowered the deficit midway through their terms,

but they all exited the White House in a year with a higher deficit than the year they entered.