- Joined

- Oct 12, 2005

- Messages

- 281,619

- Reaction score

- 100,389

- Location

- Ohio

- Gender

- Male

- Political Leaning

- Libertarian - Right

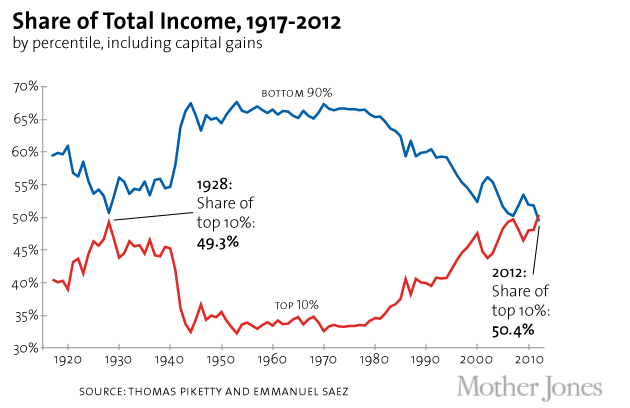

Obama raised taxes on the top earners while keeping the cuts for the other brackets. Biden is going to do the same. We cannot afford to keep subsidizing the top 1%'s nest eggs.

the top one percent pays a bigger share of the income tax now than at almost any other time They subsidize your government benefits