- Joined

- Jan 21, 2009

- Messages

- 65,981

- Reaction score

- 23,408

- Gender

- Male

- Political Leaning

- Undisclosed

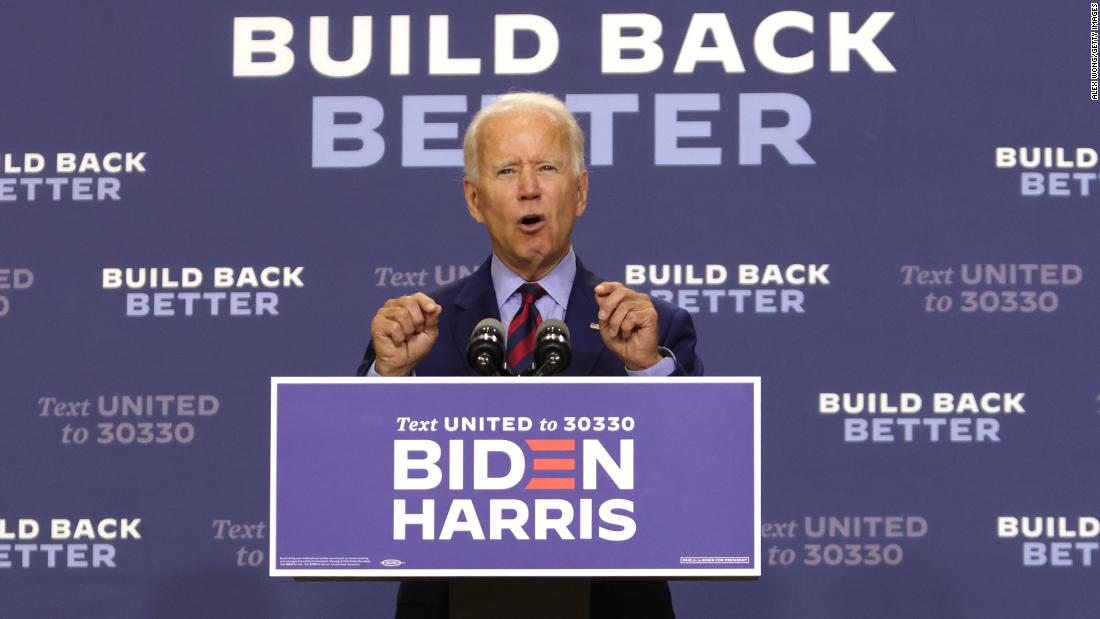

Biden’s tax plan could create a tax rate of as much 62% for New Yorkers and Californians, studies show

High earners in New York and California could face combined federal and state tax rates of 62% under Democratic presidential nominee Joe Biden’s tax plan, according to experts.

www.cnbc.com

www.cnbc.com

Do you get to keep 38%% of your income? No, of course not.

You also have to pay 7.25% sales tax. You have to pay property taxes directly or indirectly thru rent. There are taxes on your utility bill. A tax on every gallon of gasoline. Recycle tax on a car battery and on new tires. Taxes on your phone bill and water bill. You pay a fee for your license plate. You pay a tax at toll roads. You pay to enter government parks.

If you get to keep 20 cents on the dollar it would be a miracle. Do you think ANYONE with a lot of money will actually be paying those taxes - either by tax exemptions or leaving the USA with their money? To deal with upper and middle class people fleeing their states, the federal government will force people in other states to pay the budgets of California and New York.

And there are things they want to force you to buy - like insurance. Force everyone to do so. You must buy from only one insurance company - the government - under the Democratic Party's nationalization of health insurance plan.

High earners in New York and California could face combined federal and state tax rates of 62% under Democratic presidential nominee Joe Biden’s tax plan, according to experts.

Biden's tax plan could create a tax rate of as much 62% for New Yorkers and Californians, studies show

While Americans earning less than $400,000 would, on average, receive tax cuts under Biden's plan, the highest earners would face double-digit increases in their official tax rates, according to nonpartisan analyses.

Do you get to keep 38%% of your income? No, of course not.

You also have to pay 7.25% sales tax. You have to pay property taxes directly or indirectly thru rent. There are taxes on your utility bill. A tax on every gallon of gasoline. Recycle tax on a car battery and on new tires. Taxes on your phone bill and water bill. You pay a fee for your license plate. You pay a tax at toll roads. You pay to enter government parks.

If you get to keep 20 cents on the dollar it would be a miracle. Do you think ANYONE with a lot of money will actually be paying those taxes - either by tax exemptions or leaving the USA with their money? To deal with upper and middle class people fleeing their states, the federal government will force people in other states to pay the budgets of California and New York.

And there are things they want to force you to buy - like insurance. Force everyone to do so. You must buy from only one insurance company - the government - under the Democratic Party's nationalization of health insurance plan.

:max_bytes(150000):strip_icc()/173313536-resize-56a7548e3df78cf77294af01.jpg)