Obama smothered the economy with his tidal wave of ideological regulations from his politicized and used as political weapons federal agencies in the middle of a financial collapse and recovery. That's a matter of fact....

Please, spare us.

The only industry that really got socked with regulations was the health sector. Most of that was health insurers -- and the regulations were mostly devised to

keep the health insurers in business, by guaranteeing them customers. They also used regulations to make sure that insurers did not sell crappy useless policies to ratepayers -- oh, the horror!

Or perhaps you were perfectly fine with Wells Fargo fraudulently slamming its customers with fake fees, and think the CPFB was wrong to "interfere in the markets" by investigating and fining WF's illegal behavior?

And again, I see little indication that Reagan, Bush 41, Bush 43, Trump have significantly reduced regulation. They certainly didn't shrink the size of the government.

Except that same 'aging population', a few years older, now have a rather positive economy, don't they?

Uh, hello? Annual GDP growth rates have been in the same "tepid" range since 2010. Please, make up your mind about your assessment, kthx.

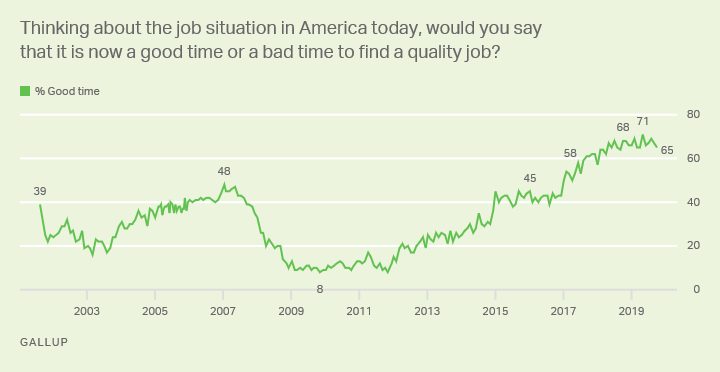

What's the matter with historic low unemployment that we have now?

For starters, U3 is only one measure of the health of the job market. That's why Janet Yellen had an entire dashboard which included LFPR, quits rate, wages, job openings rate, long-term unemployment, and so on. (Some of those do well, others do not.)

To continue, U3 is not designed to tell us how income for the 99% have been stagnant since the early 1980s, while almost all of the income gains have been captured by the top 1% (or less).

U3 doesn't tell us how or why, for years, kids cannot expect to have a better standard of living than their parents.

Oh, and let's not forget that U3 started to fall in

January 2010.

What's the matter with historic high labor participation rate that we have now?

Is that a joke? LFPR is not at historic highs. It peaked in the late 90s around 67%, started falling in 2001, and has been flat at 62% since late 2015.

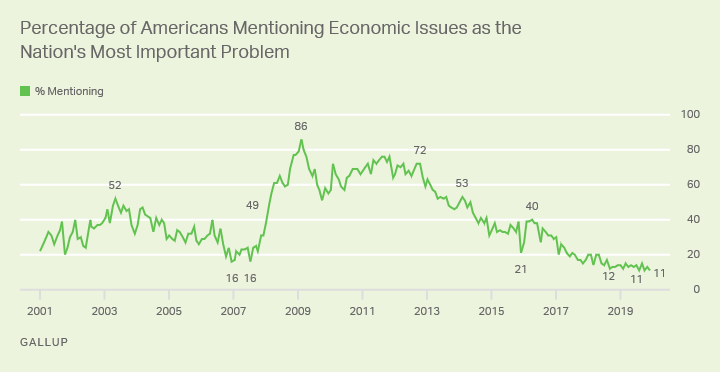

What's the matter with the prosperity that we have now?

Holy crap. I could be here all day with that one. Just for starters:

• Income inequality is rising, which tilts power and future prosperity towards the already wealthy

• Wages are stagnant for everyone else

• Inequality doesn't just apply to individuals; parts of the US (mostly rural areas) are falling further and further behind, while cities are continuing to improve and gain most of the growth and advantages

• There are still nearly 40 million people in poverty -- and there would be millions more if it wasn't for government programs, notably Social Security and Medicare

• Racial disparities in income and wealth and opportunity are still rife

• Mobility is nowhere near where it should be

• We still have millions who can't afford health insurance

• Automation is already dislocating millions of jobs, and news flash! the free markets don't offer free job retraining, or magically allocate jobs to areas of low unemployment

• Labor rights and protections are weak, and workers don't feel secure

• Sectors like retail are collapsing

The public policies from this administration seem to have helped these things along.

Why are you rooting and supporting public policies that are antithetical to these positive things?

Are you referring to the Trump administration? They haven't done JACK **** to help the economy. Trump came into office with a massive economic tailwind, and has enacted few policies. One was the tax cut, whose largest beneficiaries were corporations, the already-wealthy, and people who *COUGH* use the same corporate structures as the Trump Organization. The other is these inept tariffs, which have hurt average Americans (especially farmers), outraged our allies who see through the transparent excuses for levying the tariffs, trashed America's reputation abroad, and didn't even accomplish Trump's own deeply mistaken goal of reducing trade deficits.

No, I did not want 'the US to have 30% unemployment for a decade'. The housing bubble was far more complex than the rather simplistic view you are presenting. Sure, there were government oversight failures, one of which was not reigning in Fanny, Freddie and ACORN at the time.

lol

It's only "simplistic" because there's a 5000 character limit. But speaking of simplistic failures, blaming FNMA/FNMC and ACORN (?!?) has got to take the cake. That is the kind of conservative/libertarian bull**** which makes it obvious you don't have a clue what happened.