Crunch

DP Veteran

- Joined

- Mar 18, 2009

- Messages

- 4,063

- Reaction score

- 890

- Gender

- Male

- Political Leaning

- Conservative

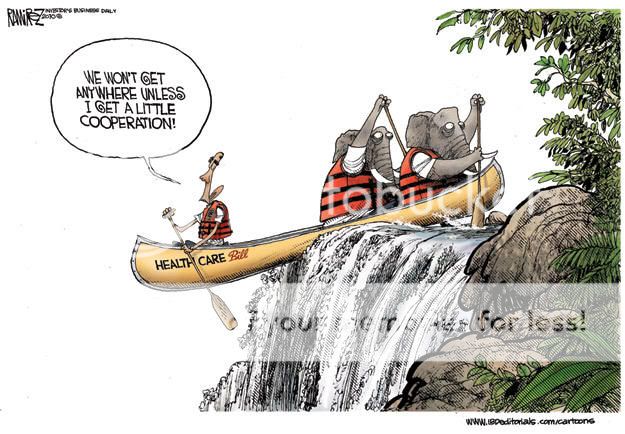

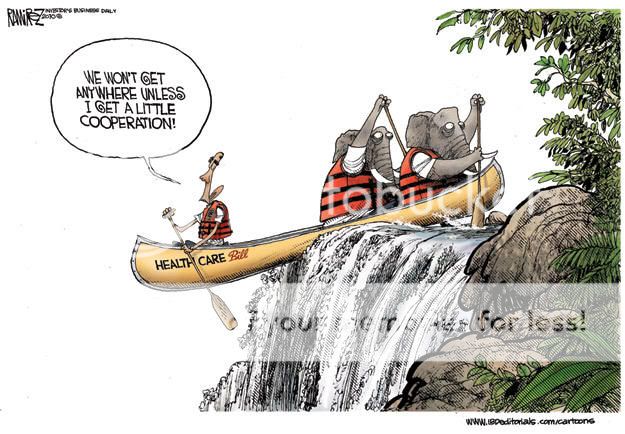

This is a dumb cartoon.

Stolen from this....

I don't think the libs have ever had an original idea....

This is a dumb cartoon.

why is that morbid? until recently, that tax has been in place for years.

Randel, please explain to us all how tax rate cuts that grew revenue caused a deficit? Liberals seem to believe that tax cuts need to be paid for and buy the liberal line. Tax cuts are individuals and corporations first thus individuals and corporations aren't entities of the govt. that are an expense. Liberals just are too bullheaded to admit their ideology is a failure.

Liberals think tax cuts will bring in less revenue because the economy has never grown with liberals in power..... and God knows Republicans can't do anything right. :roll:

Liberals have a problem with the basic concept of tax home pay and the affects of tax cuts on that take home pay. Further they do not understand human behavior and what people do with extra money in their paychecks.

To a liberal a tax cut means less revenue but to a conservative a tax cut means more economic activity.

To a liberal a tax cut is an expense to the govt and has to be paid for

To a Conservative a tax cut is allowing people to keep more of what they earn and since it is the people's money first it cannot be an expense thus does not have to be paid for.

Liberals brainwashed, conservatives have logic and common sense.

Let's see.... somebody works all their lives, pays their tax on their income, and saves or invests their money. (and pays tax on any income from the savings or investments)

Then they die.

And you think it's fair or right to take 45% more?

Let's see.... somebody works all their lives, pays their tax on their income, and saves or invests their money. (and pays tax on any income from the savings or investments)

Then they die.

And you think it's fair or right to take 45% more?

They should put it all in a trust.

How does a farmer put land and equipment into a trust?

By declaring them in his trust?

You can make a business a trust?

You can make a business a trust?

I'm not sure. It may depend on the class of business it is. A family farm that isn't incorporated may be able to.

:lamo son, i've debated much better than you, debated folks who actually made me stop and think, and question some of the views i have. i know a diehard lib who could twist you into a pretzel....You are right, 16 million unemployed Americans is cherrypicking in your world. Sorry but you simply haven't a clue as to what you are talking about. Keep that head buried in the sand. I have seen nothing from you that refutes any of the data I have posted. You need to learn what debate is all about, your opinions don't mean squat here, get the facts and back those facts up. Refute the BLS data I posted.

You can make a business a trust?

And more economic activity means more revenue even with a lower tax rate...... proven every time it's been done.

But like I said.... to a lib, Republicans never do anything right, so of course, libs will never learn the lessons they should.

as we have a budget that neither side has balance in years, yes. this is an important revenue stream, and seeming that those who are taxed are dead, no, i have no problem with it.Let's see.... somebody works all their lives, pays their tax on their income, and saves or invests their money. (and pays tax on any income from the savings or investments)

Then they die.

And you think it's fair or right to take 45% more?

as we have a budget that neither side has balance in years, yes. this is an important revenue stream, and seeming that those who are taxed are dead, no, i have no problem with it.

i would be willing to see the exemption raised to between 4-8 million.But that doesn't mean we should have ridiculously low exemption amounts. Hitting $1 million is really, really really easy for even middle class folk when you incorporate pension and life insurance. I don't think it's a good idea to have that low exemption amount especially when the primary breadwinner dies and has kids. We should just go to a 40% rate with exemption of $10 million with adjustments to inflation to the exemption amount.

I don't understand liberals, who seem to not understand that it is the taxpaying liberals whose money is being spent as well as Conservative money to fund over two years of unemployment benefits. The brainwashing is absolutely incredible.

They should put it all in a trust.

Rep Opponent: In actuality I just voted against not paying for them; and suggested we take unspent Stimulus Funds to cover the cost, much like the pay-go system my Democratic Opponent voted into law and then ignored. Why is my opponent willing to break the law in order to avoid his legal obligation to make America more solvent?

Absolutely. Put the assets of the business into a trust. Pay taxes on them now and pay none later independent of any appreciation.

Yet very very accurate.This is a dumb cartoon.